One of us longed for an ownership pad in Delhi NCR that he could call his own. But it is no secret that immovable property prices in the National Capital Region have sky rocketed since ages and it is practically impossible to buy a house without an institutional financial support. To this end, he had some enlightening experience with PNB Housing Finance. This is that story.

“I recently had some enlightening experience with PNB Housing Finance and thought of sharing that here.

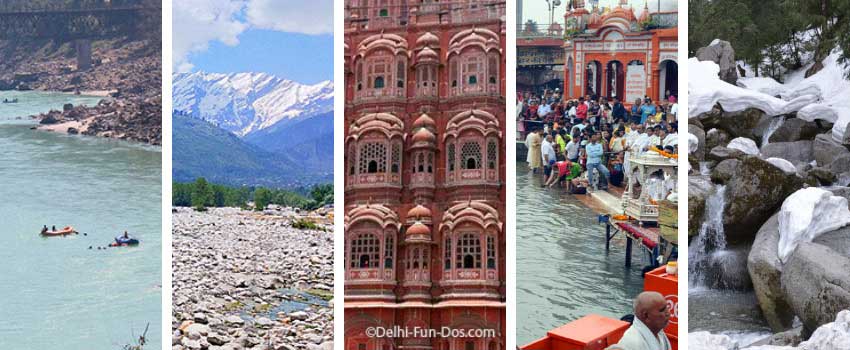

Not to say that I have been pretty bohemian in nature and that is evident from my social media page. If I have begun the week in the chill of the high Gunehar village in Himachal Pradesh, I have ended it visiting the Kanak Durga temple in the warmth of Vijaywada, Andhra Pradesh. And yet, at some point I longed for an ownership pad in Delhi NCR that I could call our own.”

Now there is no dearth of home loans for this purpose. One opens the newspaper and can’t but be tempted by the lucrative deals that financial institutions offer to draw customers. But our friend here was discouraged by many on the ground that the process for obtaining a home loan was easier for a salaried individual but complex for the self employed. He decided to take the naysayers in his stride and contacted the housing finance companies (HFCs) instead. It was all hunky dory till rubber met the road when he realized that as a self employed individual, the loan process was indeed somewhat different. Although this is his story, we wanted to break some myths and put up a layman’s reckoner on this topic of self employed borrowers and bank loans.

Firstly, contrary to popular belief, banks/financial institutions these days are way more forthcoming and are adopting a favorable view vis-a-vis self employed individuals. After all given the start-up boom, the self employeds are the new stars on India’s current financial sky. During the initial conversations, we came to know that PNB Housing Finance offers customized plans for self employed borrower with many convenient features. Some like they offer loans for 30 years, top up loans, loans against existing property, step up EMI which means one can start paying with lower EMI and then increase it gradually with the growth in income, etc.

Contrary to salaried customer where they have salary slips etc to prove income, my friend did not have salary as he runs business. Hence, we were not sure how well they will be able to assess the income and will it mean they may offer me less loan or higher interest rate. But the official explained that PNB Housing has devised ways by which they can ascertain the income in a better way.

The official asked for his balance sheets, profit and loss accounts, income tax filings and other financial papers since last few years. He was told that he stood a better chance of getting a home loan if copies of consecutive IT returns for the prior 3 years could be provided. This stretched the eligibility for higher loan requirements. Any income from other sources – rentals from other properties and income from investments were also considered while analyzing his profile.

He even explained that since my friend had been prudent in his earlier loan repayments and had not defaulted on any liability, his credit score was good which made the loan sanction easier.

The loan sanction as well as disbursal were quicker than expected. But yes, another reason was that my friend had always been very synchronised with his douments, hence all supportings like identification proofs, property documents and other requisites were handed over to the PNB Housing official without delays and discrepancies.

Their after-disbursal services have been equally good. They have their own mobile app where customer can avail IT certificates or any other related document 24X7. If not mobile, one can also access their personal accounts through customer portal on their website. They have a chat system on website too where we can ask queries or call up the toll free. All this has made resolutions quick and convenient. More so, their digital services are extremely convenient and can be availed anytime anywhere.

All in all – his home loan approach was way smoother than what he thought. In fact, he has just moved in to an apartment in an upscale housing society in Gurgaon and is busy setting up his dream pad. That, we all thought was so cool.

So all you free souls out there who chose to be mavericks and do your own thing than towing the line – this piece is for you. Thanks to friendly financial organizations like PNB Housing Finance, your pad or palace is now as achievable as the next bright idea that crosses your mind.

I love that this is available to those of us that are self-employed. I’ll have to research it more.

Very interesting to learn about loans for self-employed people. I am self-employed and sometimes can be challenging to have enough money flow so this is helpful.

I am so glad that my husband deals with this. I don’t like doing all the paper work.

It is great to see that some financial institutions offer loans even if you are self-employed. My preferred option is paying cash as servicing a loan can be expensive.

This is my first time to learn about this. Well, maintaining a good credit standing is a must so you get to be approved when it comes to taking a loan. A very important one since the do credit investigations.

Great info for people wishing to buy in Delhi. Thanks for the post.

This is some good info.. I stay far away from loans because I know thats going to be a whole lot to del with later on being self employed

Oh wow! It’s nice to know that there are financial institutions that would lend to self-employed individuals.. It’s kind of hard to do this when one is self-employed.

It is a challenge to grant a loan for self-employed, however if you have good credit status that is a huge advantage as well. Proper documentation and maintaining a good credit score is a must.