Travel is the best teacher they say. We can’t agree more. Among many other skills, travel taught us how to invest to reach our goal. Our go-to investment platform is SIP and here is how.

Why we travel ?

Do forgive the nostalgia, but DelhiFunDos was conceived to share our varied experiences in terms of food, travel, culture and so on. There was no priority, and we did not like any one activity more than the other. But the year 2020 got us to look at things differently. Locked down in our homes, we felt trapped, like a bird in the cage. In introspection, we realised, over time we had changed. Among all the activities that we engaged in, what excited us most was travel! We felt guilty – it was like loving one child more than the other. But when we dug deeper, we had, as they say, an epiphany! Travel was not just moving from place A to place B. It was so much more. Once we were in place B, we would enjoy the new surroundings, try local cuisine, visit museums and art galleries, watch regional music, concert or theatrical performances and imbibe as much as possible of the new place. When we would return, we would be richer by the wholesome travel experience! In other words our holistic approach to travel combined our passions for food and culture as well. This truth set us free as we planned our next travel.

How we travel ?

When we plan a trip, the first issue that we need to work on is the budget. This is a question that we face very frequently. Many followers tell us, “We would love to travel, but we do not have funds!”

Budget is indeed an important, if not the most important factor that you need to bear in mind when planning travel. You can be frugal during the trip, yet, you need to have your basics such as the ticket, lodging, local transport and food covered. Given the subsistence costs, how do you arrange for these funds?

To this end, we suggest that you invest consistently with travel as a goal in mind.

How you can invest ?

There are many investment options in India, some conventional, some contemporary. The safest form of investment is perhaps a Fixed Deposit or FD at a bank. As an investor, you are free to decide on the quantum and duration of the investment. As long as you are confident about the stability of the bank, your risks are minimal.

Another option is investing in bonds and debentures. Bonds are issued by public sector undertakings and are secured by assets so relatively safe. Debentures are not secured by assets.

There is a third form of investment – mutual funds. Mutual funds are minimum risk investments but with high returns. There are many mutual fund processes. In our bid to arrange travel funds, the Systematic Investment Plan (SIP) mutual funds work best for us. A SIP investment can be started with as little as Rs.500 each month, and it can help the investor to accumulate a sizable amount over time to reach their goals. With proper investment planning, a SIP can help defeat the impact of inflation on the investment and optimally grow the funds in the long run.

Most popular financial institutions offer SIP mutual fund schemes. We are not really finance-people but we have found L&T Mutual Fund processes and schemes user-friendly and something a layperson can understand. Once we have set an eye over a destination, we make a budget, add 25% on that for contingency and invest consistently in L&T Mutual Fund SIP. SIP investments have worked as an effective way of how we fund our travels.

Successful investment mantra

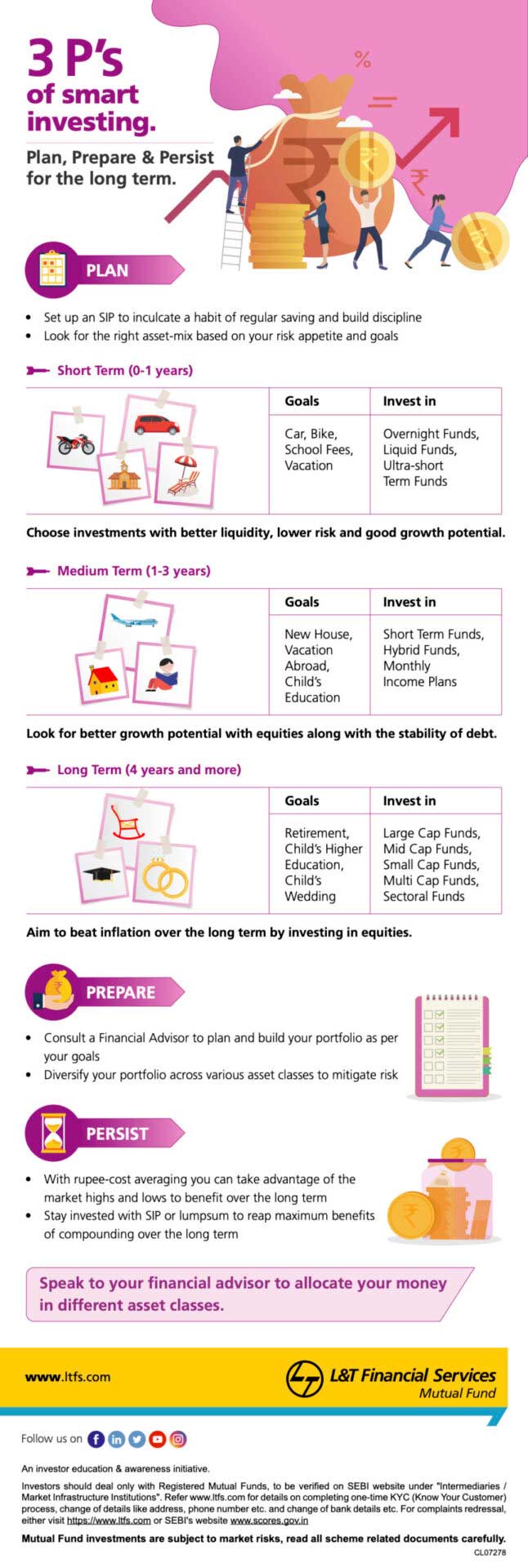

While we leave you with that thought, going through the L&T Mutual Fund website, we came across this interesting infographic that we want to share here. In very simple language, this chart provides a very easy to follow guideline as to how to be successful in investing. Some of these are like home-truths that always have repeat value. Hope it helps you as much as it motivated us.

All of us want to have a vacation at the most exotic location. If you want to go on a cruise, a backpacking tour through beautiful California, or enroll in a surfing course, you can start a SIP! We suggest you start afresh SIP for each travel goal. This way you ensure that you fulfill your travel list without burning a hole in the pocket!

In the end a piece of suggestion-always have the habit of reading the scheme-related documents before investing to understand the scheme type, investment patterns, and the risk factors associated with particular investments and consult your financial advisor to understand the implication of any investment.

Disclaimer: This information is for general information only and does not have regard to the particular needs of any specific person who may receive this information. L&T Investment Management Limited, the asset management company of L&T Mutual Fund or any of its associates; does not guarantee/indicate any returns/and shall not be held liable for any loss, expenses, charges incurred by the recipient. The recipient should consult their legal, tax, and financial advisors before investing. The recipient of this information should understand that statements made herein regarding future prospects may not be realized or achieved.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.

Pin it

Truth be told. I have never invested in mutual funds. After reading your post, I’d be itching to invest in L&T Mutual Fund SIP for all my travel goals. Just like both of you, even I hope to fulfill my travel goals this year, without burning a hole in the pocket 🙂

Must say this is detailed post, I have saved the post and will reread again. Thank you for such a detailed explanation.

I’ve been meaning to invest money in one of the three tools that you’ve mentioned. SIP has been trending for a while with investors in comparison to debentures and fixed deposits. And the chart that you found, very informative. It basically goes onto set my priorities and savings straight. Thank you for writing this piece.

Hi, You have shared very amazing information for investing and I would love to invest in mutual funds & crypto currencies. Thank you & keep sharing.